Financial Services Sector

Quick Introduction:

The financial services sector is under constant threat from cyber-criminals, with risks ranging from data breaches and financial fraud to systemic attacks on the stability of financial institutions. In the UK, firms are under the aegis of a series of robust cyber-security regulations designed to fortify the industry against such threats. These regulations demand not only strict compliance but also a proactive stance on cyber-security, ensuring the protection of critical financial infrastructure and sensitive customer data.

![]()

Cyber-security Regulations

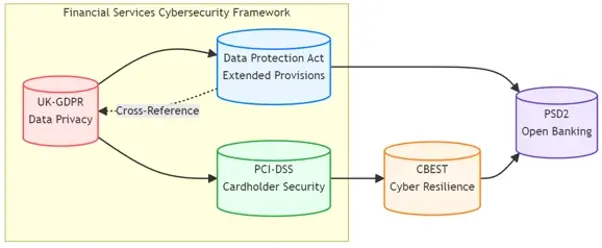

UK-GDPR: Prioritizing Data Privacy in Finance

The UK General Data Protection Regulation (UK-GDPR) mirrors its EU counterpart in its rigorous approach to data privacy, adapting it to the specifics of UK law post-Brexit. For financial services, this means stringent controls over the processing of personal data, an obligation to implement data protection 'by design and by default', and the need for clear consent mechanisms, especially in the context of digital banking and financial advising.

PCI-DSS: Securing Cardholder Data

The Payment Card Industry Data Security Standard (PCI-DSS) sets the bar for protecting cardholder information during and after financial transactions. Given the volume of credit and debit card use in financial services, compliance with PCI-DSS is not only mandatory but critical to maintaining customer trust and avoiding the reputational damage that comes with data breaches.

Data Protection Act 2018

The Data Protection Act 2018 providing a framework that's specifically tailored to the UK context. Financial services must align with its provisions for processing personal data, with a particular focus on areas such as data subject rights, data protection impact assessments, and data sharing across borders.

CBEST: Strengthening Cyber Resilience

CBEST is a framework designed to improve the cyber resilience of the UK financial system. It involves rigorous testing and analysis of financial institutions' critical systems to assess their vulnerability to cyber-attacks. Compliance with CBEST standards means not just ticking regulatory boxes but ensuring that the very infrastructure of financial services can withstand sophisticated and persistent cyber threats.

The Financial Conduct Authority (FCA)

The FCA's regulations focus on protecting consumers, ensuring the integrity of the financial industry, and promoting healthy competition between financial services providers. Cyber resilience is a key part of the FCA's mandate, with guidelines for firms to identify vulnerabilities and to report cyber incidents to the Financial Conduct Authority by following the NCSC guidelines.

Senior Managers and Certification Regime (SMCR)

The Senior Managers and Certification Regime (SMCR) intensifies the personal responsibility of executive leaders within the financial services sector. This regime emphasizes the accountability of roles overseeing IT and cybersecurity, mandating that senior management remains vigilant and proactive in mitigating digital threats. Inherent in managing SMCR is the meticulous recording and handling of critical data that must be securely preserved. The complexity of safeguarding this data is further amplified by the widespread adoption of hybrid work models across the financial services industry.

PSD2: Innovating Payment Security

The Revised Payment Services Directive (PSD2) has introduced a new era of open banking, where security and innovation go hand-in-hand. Financial services firms are now required to open up their payment systems to third-party providers, all while maintaining rigorous security standards to protect consumer financial data.

ProCheckUp Solution's

UK-GDPR Compliance:

- IASME Cyber Essentials: A certification that verifies basic cyber-security hygiene, ensuring that financial institutions have fundamental security controls in place to protect against common cyber threats. (Learn More)

- IASME Cyber Assurance: This includes a GDPR readiness assessment to ensure that all aspects of data privacy and security are addressed, thus aligning with the GDPR’s stringent requirements.(Learn More)

For Data Protection Act 2018 Adherence:

- Data Protection Impact Assessments (DPIA): Services to help financial institutions conduct assessments that evaluate the impact of new projects or technologies on the privacy and security of personal data.(Learn More)

- Data Governance Consulting: Expert consultancy to ensure the correct handling of personal data across all operations, aligning with the Data Protection Act’s provisions.

For PCI-DSS Compliance:

- PCI-ASV (Approved Scanning Vendor) Services: ProCheckup, a globally recognized ASV, conducts meticulous external vulnerability scans to ensure the integrity of systems handling credit card data, in compliance with PCI-DSS requirement 11.3.2. Our ASV scan solution leverages cutting-edge security tools to rigorously test and confirm your network's defenses against known threats, helping to secure your data transactions. (Learn More)

- PCI-QSA (Qualified Security Assessor) Services: As an independent QSA firm accredited by the PCI Security Standards Council, ProCheckup embodies excellence in ensuring entities meet the stringent standards of PCI DSS. Our longstanding expertise, since the establishment of the QSA program, provides reliable validation of your compliance posture. (Learn More)

- Penetration Testing: ProCheckup's penetration testing services are an embodiment of our commitment to security excellence, meeting PCI-DSS requirement 11.4.1. Our team of Crest, Cyberscheme, and NCSC-qualified penetration testers, with a proven 24-year track record since 1999, employs a comprehensive approach to identify and remediate exploitable security vulnerabilities. (Learn More)

- Data Discovery for Primary Account Number (PAN): Our specialized services extend to the detection of PAN within your network, particularly identifying unauthorized storage locations outside the Cardholder Data Environment (CDE), adhering to PCI-DSS requirement 12.5.2. ProCheckup ensures that sensitive payment data is contained and managed securely. (Learn More)

- Segmentation Testing: With precise technical testing, ProCheckUp validates the efficacy of network segmentation, ensuring that the CDE is isolated from all systems not pertinent to card processing , in compliance with PCI-DSS requirement 11.4.5 This critical service supports PCI-DSS compliance by verifying the robustness of segmentation controls, maintaining the security of your cardholder data environment. (Learn More)

- Wireless Testing: Adhering to the stringent standards of PCI-DSS requirement 11.2.1, our team conducts comprehensive wireless testing quarterly. This process is meticulously designed to uncover and assess both sanctioned and unsanctioned wireless access points within your network, ensuring a robust security posture. (Learn More)

For CBEST Compliance:

- CBEST Intelligence-led Testing: Services that include simulating a targeted attack on financial institutions’ critical systems to assess resilience, as mandated by the CBEST framework.(Learn More)

- Threat Intelligence Services: Monitoring and analysis of potential threats specific to the financial sector, to prepare for and mitigate sophisticated cyber-attacks.

For Adherence to FCA Guidelines:

FCA Cyber Resilience Audits: A comprehensive review of cybersecurity practices against the FCA’s guidelines to ensure that vulnerabilities are identified and addressed.

Incident Reporting Mechanisms: Implementing and testing procedures for prompt incident reporting to the FCA in accordance with NCSC guidelines. (Learn More)

For SMCR Requirements:

- SMCR Compliance Software: Tools that help in managing the recording and handling of data related to personal accountability, ensuring it remains secure, especially within hybrid work models.

- Cyber security Leadership Training: Tailored training programs for senior managers to foster a culture of cyber resilience and to support decision-making processes regarding IT and cyber-security risks.

For PSD2 Compliance:

- API Security Testing: Assessing the security of APIs that are essential for open banking, ensuring they are resilient against cyber-attacks while allowing secure access by third-party providers.

- Strong Customer Authentication Solutions: Implementing multi-factor authentication processes that comply with PSD2’s requirements for secure customer authentication.

By integrating these cyber-security services, financial institutions can effectively navigate the complexity of regulatory compliance while fortifying their defenses against the cyber threats that endanger the sector’s integrity and stability. These services provide a scaffold for building a comprehensive cyber-security strategy that is not just about adherence to the letter of the law but also about embedding cyber-security into the fabric of financial services operations."

Maintaining Compliance

Implementing Robust Cybersecurity Frameworks

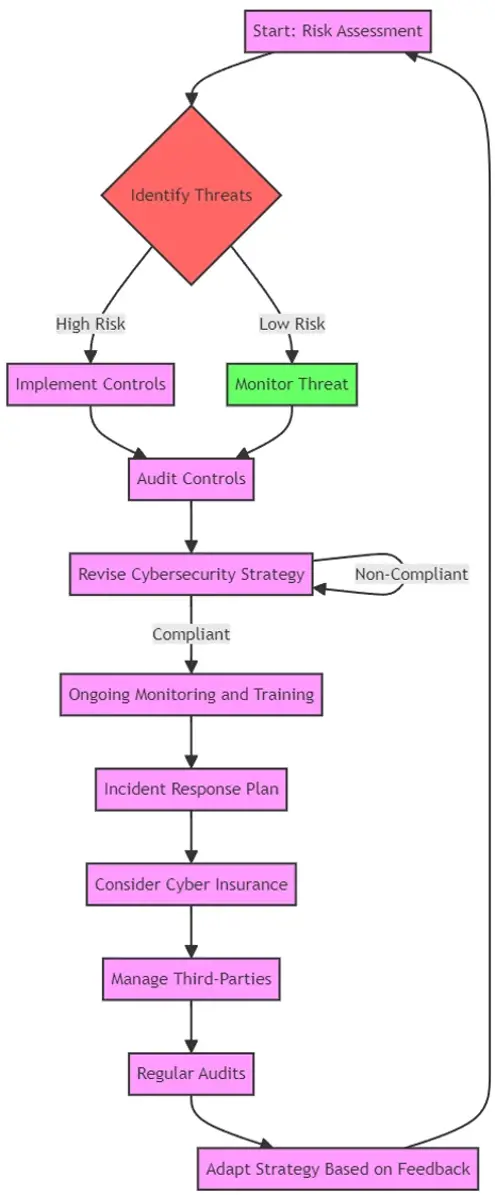

To keep up with the dynamic nature of cyber threats and regulatory requirements, financial services firms are encouraged to implement robust cyber-security frameworks that are responsive and adaptive. Here's an overview of what this involves:

- Risk Assessment and Management: Regular risk assessments to identify and prioritize potential threats, followed by the development of a risk management strategy that includes appropriate controls and mitigation tactics.

- Employee Training and Awareness: Continuous education programs for all staff members to recognize phishing attempts, manage sensitive data correctly, and understand their role in the organization's cybersecurity posture.

- Incident Response Planning: A well-structured incident response plan that outlines procedures for detecting, responding to, and recovering from cyber incidents to minimize impact and resume normal operations as quickly as possible.

- Technology and Access Control: Deployment of state-of-the-art cybersecurity technologies, alongside strict access controls to ensure that only authorized personnel have access to sensitive systems and data.

- Regular Audits and Compliance Checks: Conducting internal and external audits to ensure all cybersecurity measures are effective and in compliance with the relevant regulations.

- Investment in Cyber Insurance: Considering cyber insurance to mitigate financial losses from cyber incidents, which can also require organizations to maintain certain cybersecurity standards to qualify for coverage.

- Vendor and Third-Party Management: Ensuring that third-party vendors and partners also comply with cybersecurity standards to avoid breaches stemming from external sources.

Cybersecurity Process Flow Chart

Cybersecurity Collaboration and Sharing

In addition to the internal measures, it is crucial for financial services to actively participate in sector-wide cyber-security initiatives. These include:

- Information Sharing: Engaging in information sharing platforms such as the Financial Services Information Sharing and Analysis Center (FS-ISAC) to receive timely alerts on threats and share best practices with industry peers.

- Regulatory Engagement: Maintaining an open dialogue with regulators to stay ahead of new regulations and to influence policy development with real-world insights.

- Public-Private Partnerships: Partnering with government agencies to enhance the collective cybersecurity posture and respond more effectively to national security threats.

- Global Cybersecurity Standards: Aligning with global cybersecurity standards and frameworks, such as ISO/IEC 27001, to ensure a consistent approach to managing information security.

- Cybersecurity Advocacy: Advocating for stronger cybersecurity measures and more substantial investments in cyber-security at industry conferences and in public forums.

With these resources and strategies in place, financial services providers can better anticipate and counteract the evolving cyber threats they face, ensuring trust and continuity in the digital age.

For More Information Please Contact Us

ACCREDITATIONS