Introduction

The financial sector remains one of the most targeted by cyber-criminals, due to its critical role in the economy and the sensitive nature of the financial data it holds. It is crucial for financial institutions to adapt to the emerging cyber-security challenges that can threaten their stability and customer trust. This articles delves into the specific risks facing the financial sector and outlines the strategic measures to bolster defences against these evolving threats.

Table of Contents

- Introduction

- Understanding the Cyber Threat Landscape for Financial Institutions

- Enhancing Defenses Against AI-Driven Threats

- Combating Sophisticated Ransomware Tactics

- Addressing Threats from the Dark Web

- Mitigating Risks of Third-Party Services

- Advanced Phishing Attack Prevention

- Prioritising Infrastructure and IoT Security

- Countering State-Sponsored Cyber Threats

- Responding to Advanced Social Engineering Attacks

- Implementing a Zero Trust Security Model

- Strengthening Cloud Security Practices

- Key Components of an Effective IR Plan

- Conclusion: Staying Ahead of Cyber Threats

Understanding the Cyber Threat Landscape for Financial Institutions

The financial sector continues to be a lucrative target for cyber-criminals due to its crucial role in the global economy and the sensitive financial nature of the data it handles. The threat landscape in 2024 has become increasingly complex, influenced by advanced technologies, evolving cyber attack methodologies, and the ever-expanding post COVID digital footprint of financial services. This makes it imperative for financial organisations to stay ahead of potential security challenges to safeguard their assets and maintain customer trust.

Key Threats Facing Financial Institutions:

Advanced Persistent Threats (APTs):

- APTs are targeted attacks that persist over extended periods, aiming to steal data or disrupt operations subtly. These threats are typically orchestrated by state-sponsored or highly organised criminal groups, leveraging their extensive resources to achieve their goals, making them highly dangerous and difficult to detect.

Ransomware Attacks:

- Financial institutions are prime targets for ransomware due to the financial nature of their data and systems, with attackers targeting financial institutions for higher ransom demands. The evolution of ransomware has seen it grow from mere data encryption to complex double and triple extortion tactics, where attackers not only encrypt data but also threaten to publish it unless additional ransoms are paid.

Social Engineering And Phishing

- Despite being one of the oldest types of threats, attackers are increasingly using sophisticated social engineering techniques to bypass technical defenses, exploiting human factors to gain access to secure systems.phishing continues to be effective, especially when powered by sophisticated A.I based social engineering techniques. Financial institutions often face spear-phishing attacks that target specific individuals or roles within the organization with highly personalised messages.

Insider Threats:

- The human element within financial organisations remains one of the weakest links in cyber-security. confidence in banking has been eroded by by the placement of criminals within financial institutions. Who have access to sensitive systems and data and are involved in deliberate theft, leaking customer financial data, as well as unintentional breaches due to negligence or lack of training.

Third-Party and Supply Chain Risks:

- Financial institutions rely on a network of vendors and service providers, each potentially providing an entry point for cyber-criminals if one of them is compromised. This was demonstrated by numerous high-profile breaches where attackers gained access through less secure partners.

Emerging Technologies:

- As financial institutions innovate with new technologies such as blockchain, IoT devices, and advanced cloud services, they also introduce novel vulnerabilities. With each new technology platform, also opening up new avenues for cyber attacks.

Strategies for Mitigation:

Threat Intelligence Sharing:

- Engaging in or forming alliances for sharing real-time threat intelligence with other financial entities and cyber-security bodies can provide early warnings of emerging threats.Developing and maintaining a robust threat intelligence capability is crucial. This involves not only monitoring known threats but also predicting new ones through the analysis of trends and emerging tactics in the cyber-criminal world.

Enhancing Defense Against AI-Driven Attacks

- Artificial Intelligence (AI) is transforming the landscape of cyber-security, both as a tool for defenders and a weapon for attackers. AI-driven attacks are particularly concerning for financial institutions due to their speed, stealth, and ability to learn and adapt to defences over time.

Enhanced Detection and Response Capabilities:

- Utilising advanced detection systems and developing rapid response protocols can minimize the impact of breaches. This includes deploying AI and machine learning technologies to detect unusual patterns that human analysts might miss.

Employee Training and Awareness Programs:

- Regular training sessions aimed at all levels of the organisation can significantly reduce the risk of successful phishing attacks and insider threats. These programs should cover current cyber threat tactics and the importance of following security policies.

Strengthening Third-Party Risk Management:

- Financial institutions should enforce stringent security requirements for all vendors and continuously monitor their compliance. This includes conducting regular audits and requiring immediate reporting on security incidents.

Robust Access Controls

- Implementing strict access control and authentication processes can prevent unauthorized access, particularly for high-risk operations.

Adopting a Zero Trust Architecture:

- Moving away from the traditional 'trust but verify' model to a 'never trust, always verify' stance significantly strengthens security postures. Zero Trust Architecture ensures rigorous identity verification for every person and device trying to access resources on a network, regardless of whether they are sitting within or outside of the network perimeter.

Comprehensive Risk Assessments

- Regularly assessing and updating risk management strategies to address new and evolving threats is crucial.

Regulatory Compliance and Best Practices:

- Staying compliant with industry regulations not only helps in avoiding legal penalties but also guides institutions in adopting best practices for cyber-security.

Enhancing Defenses Against AI-Driven Threats

AI-driven threats are increasingly sophisticated, leveraging the power of machine learning and automation to carry out attacks at unprecedented speed and scale. Understanding these threats is essential for financial institutions to develop effective defensive strategies.

Key AI-Driven Threats to Financial Institutions:

AI-Powered Phishing Attacks:

- Description: Attackers use AI to craft highly convincing phishing emails and messages that mimic trusted sources, increasing the likelihood of deceiving recipients. By analysing vast amounts of data, these AI systems generate personalized, context-aware content that significantly increases the likelihood of deceiving recipients.

- Impact: Such attacks can lead to unauthorized access to sensitive financial data, causing financial losses and damaging trust in the financial sector.

Adaptive Malware:

- Description: This new type of malware under development uses AI to analyse the environment it infects and adapts its behavior accordingly. It can alter its code and methods to evade detection, making it much more resilient and harder to counter.

- Impact: Adaptive malware can persist inside networks for extended periods, causing ongoing damage and complicating eradication efforts.

Automated Vulnerability Discovery:

- Description: Attack software under development driven by AI algorithms can scan and analyse financial environment to identify vulnerabilities at a much faster rate than human operators. These systems can exploit weaknesses almost instantaneously, leaving defenders with very little time to react.

- Impact: The rapid exploitation of vulnerabilities sometimes creating unique zero days can lead to widespread system breaches before security patches can be applied.

AI-Facilitated Fraud:

- Description: Fraudsters use AI LLM's to analyse patterns in transactional data to mimic legitimate transactions or to find ways to circumvent traditional fraud detection systems.

- Impact: This leads to increased instances of fraud that are harder to detect and prevent, resulting in significant financial losses.

Deepfake Technology:

- Description: AI-driven deepfake technology can create highly realistic audio or video clips of individuals such as corporate executives. These clips can be used to issue fraudulent instructions or manipulate stock prices.

- Impact: The use of deepfakes can lead to severe reputational damage, misguided decisions based on false information, and financial manipulation.

Mitigation Strategies:

Layered Defense Strategy:

- Implement multiple layers of security measures to mitigate the impact of a potential breach, including firewalls, behavior analysis, and intrusion detection systems.

Collaboration and Sharing of Threat Intelligence:

- Work with other financial institutions and cyber-security entities to share real-time intelligence on emerging AI threats and countermeasures.

AI-Driven Security Solutions:

- Incorporating AI into cyber-security defences, such as using machine learning models for anomaly detection, can help identify and neutralize threats before they cause harm.

Continuous Security Updates and Patch Management:

- Keep systems up-to-date with the latest security patches to defend against vulnerabilities that could be exploited by automated AI tools.

Continuous Security Training:

- Keeping security teams informed about the latest AI-driven threat scenarios and countermeasures is vital, as is training them to use advanced tools that incorporate AI and machine learning.

Updating training programs:

- Regularly update training programs to include the latest information on AI-driven threats, such as recognising deepfake content and understanding the new A.I driven phishing tactics.

Enhanced Monitoring and Response:

- Implementing AI-powered monitoring tools that continuously analyse behaviors across networks can detect anomalies that signify a breach or an ongoing attack, enabling quicker response times.

Combating Sophisticated Ransomware Tactics

As ransomware continues to evolve, it has become increasingly complex and damaging, becoming a major threat to financial institutions, by harnessing more sophisticated tactics to extort, disrupt, and damage. The progression from simple lockout schemes to intricate multi-layered extortion has significantly heightened the stakes, making traditional defense mechanisms less effective and increasing the need for a more comprehensive response strategy. These attacks not only disrupt operations but also threaten to compromise sensitive customer financial data, leading to significant financial and reputational damage.

Evolving Nature of Ransomware Attacks:

Double and Triple Extortion Schemes:

- Description: Beyond merely encrypting data and demanding ransom for decryption, attackers now engage in layered extortion schemes that involve threatening to release sensitive data to the public, sell it on the dark web or carry out Distributed Denial-Of-Service (DDoS) attacks unless additional ransoms are paid. This layered extortion strategy puts additional pressure by increasing the urgency for institutions to respond, often forcing them to consider paying the ransom to prevent broader exposure.

by Impacting their reputation. - Impact: These tactics can lead to severe reputational damage, loss of customer trust, and significant financial penalties if sensitive data is exposed.

Targeted Ransomware Attacks:

- Description: Attackers perform detailed research and reconnaissance to identify high-value lucrative targets within financial institutions that are more likely to pay larger ransoms or where they can cause the most disruption. This includes targeting specific data-rich departments or individuals with access to critical systems.

- Impact: Focused attacks lead to higher success rates and larger payouts for attackers, while significantly disrupting operations.

Ransomware-as-a-Service (RaaS):

- Description: The proliferation of RaaS on dark web marketplaces has lowered the entry barrier for launching ransomware attacks, enable even low-skilled cyber-criminals to deploy ransomware attacks by purchasing services from more sophisticated attackers. These platforms are advertised and sold on the dark web, broadening the scope and scale of ransomware attacks.

- Impact: The democratisation of ransomware capabilities increases the frequency and diversity of attacks, overwhelming defense systems.

Mitigation Strategies:

Robust Backup and Recovery Systems:

- Regularly update backups that are stored offline and segmented from the primary network. Regularly test these backups to ensure they can be quickly restored without paying the ransom, which is essential for resuming operations after an attack.

Advanced Threat Detection and Response:

- Deploy state-of-the-art cyber-security technologies that use machine learning and behavioral analytics to detect unusual activities indicative of a ransomware attack.to limit the spread of ransomware.

Employee Training and Awareness:

- Regular training sessions are crucial to educate employees about the latest ransomware tactics and prevention measures. This includes training on how to recognise phishing attempts, which are often the initial vector for ransomware attacks.

Incident Response Planning:

- Develop and regularly update an incident response plan tailored to ransomware threats, which includes isolation procedures for infected systems and communication strategies for stakeholders. This plan should include defined roles and responsibilities, as well as crisis management procedures to handle communications with external stakeholders.

Legal and Compliance Advisory:

- Stay informed about the legal ramifications of ransomware payments and data breaches. Understand the regulatory requirements and prepare to adhere to them in the event of an attack, including reporting breaches to authorities and affected parties.

Network Segmentation:

- Divide the network into segments to limit the spread of ransomware. This containment strategy ensures critical data and systems remain isolated, reducing the overall impact of an attack.

Addressing Threats from the Dark Web

The dark web remains a significant threat to financial institutions, serving as a marketplace for trading illegal goods, including tools and services used in cyber attacks. The anonymity provided by the dark web facilitates the buying and selling of stolen customer data, malware, and even entire hacking services.

Key Concerns:

Trade of Stolen Data:

- Description: Sensitive information from financial institutions, such as credit card details, login credentials, and personal customer data, is often sold to the highest bidder on the dark web. This leads to further financial fraud and identity theft.

- Impact: The exposure of sensitive data not only results in financial losses to consumers but also damages the institution's reputation and trustworthiness.

Availability of Hacking Tools and Services:

- Description: The dark web hosts a variety of services and tools, including malware, ransomware kits, including RaaS,and hacking services, which can be acquired by those with minimal technical skills.

- Impact: This lowers the barrier for entry into cyber-crime, increasing the number and variety of attacks against financial institutions.

Communication Channels for Cyber-criminals:

- Description: Cyber-criminals use the dark web to communicate and collaborate anonymously. Forums and chat rooms allow them to exchange tactics, share successful strategies, and recruit accomplices. Leading to more effective attacks against financial institutions.

Impact: These networks facilitate the spread of malicious techniques and increase the efficiency and effectiveness of cyber attacks.

Mitigation Strategies:

Dark Web Monitoring:

- Action: Use specialised services that monitor the dark web for mentions of your institution or appearances of stolen data related to your customers. This monitoring helps in early detection, potentially before the information is used for fraudulent activities.

- Benefit: Early warning of data breaches allows for quicker response, potentially limiting the damage caused by exposed data.

Employee Training and Vigilance:

- Action: Train employees to understand the risks associated with the dark web and enforce strict security practices, such as the use of strong, unique passwords and multi-factor authentication, to reduce the risk of data theft.

- Benefit: Increased awareness and robust security practices among employees can significantly mitigate the risk of internal data leaks that could end up on the dark web.

Robust Cyber-security Measures:

- Action: Implement a multi-layered security strategy that includes advanced malware detection, robust encryption, and stringent access controls to prevent data breaches that could lead to the exposure of sensitive information on the dark web.Implement strong cyber-security defenses, including firewalls, intrusion detection systems, and comprehensive endpoint security.

- Benefit: These measures help prevent the success of attacks launched with tools acquired from the dark web.

Collaboration with Law Enforcement:

- Action: Work closely with local and international law enforcement agencies that specialise in cyber-crime and dark web activities.

- Benefit: This collaboration can help trace and mitigate threats originating from the dark web, and the apprehension of perpetrators, thereby reducing the threat landscape.

Legal and Regulatory Compliance:

- Action: Ensure compliance with all relevant data protection regulations which mandate robust cyber-security measures and breach notification procedures.

- Benefit: Compliance helps in mitigating legal and financial repercussions in the event of data being compromised and ending up on the dark web.

Mitigating Risks of Third-Party Services

Mitigating the risks associated with third-party services such as cloud providers, fintech innovations, and other IT vendors is essential for financial institutions, as these entities often have access to or manage sensitive data and systems that are critical to banking operations. However, these relationships also introduce a layer of risk, as vulnerabilities in third-party systems can directly impact the security of the financial institution, making it crucial to implement robust strategies to safeguard against potential security breaches.

Understanding Risks from Third-Party Services

Vendor Data Breaches:

- Description: Third-party services often handle sensitive financial data and may not always uphold the same level of cyber-security as the financial institution. If their security measures are inadequate, it could lead to data breaches that compromise customer information.

- Impact: Such breaches not only result in financial losses and regulatory penalties but also damage the institution’s reputation and customer trust.

Insufficient Compliance and Oversight:

- Description: Vendors might not always adhere to the stringent regulatory standards required in the financial sector, particularly concerning data protection and privacy.

- Impact: Potentially exposing the financial institutions to legal risks and penalties under various compliance regimes such as PCI, GDPR or HIPAA.

Supply Chain Attacks:

- Description: Cyber-criminals may target less secure elements in the supply chain to gain access to the institution’s networks, using the interconnected nature of services to reach larger financial targets.

- Impact: These attacks can compromise the security of the entire network, leading to widespread data breaches and operational disruptions.

Mitigation Strategies:

Thorough Vendor Vetting

- Action: Conduct extensive security assessments before on-boarding new vendors to ensure their compliance with the institution's security standards.

- Benefit: Ensures that all third-party services comply with the institution's security requirements, reducing the risk of breaches.

Continuous Monitoring:

- Action: Implement systems to continuously monitor the security postures of third-party vendors. This includes tracking their compliance with security standards and quickly identifying any breach that may impact the institution.

- Benefit: Ensures that all third-party services comply with the institution's security requirements, reducing the risk of breaches.

Strong Contractual Agreements:

- Action: Ensure that all third-party agreements include strict security and compliance clauses. Define clear requirements for cyber-security measures and incident reporting.. Include clauses for breach notification and the right to audit.

- Benefit: Legally binds vendors to adhere to security standards and enables the institution to take swift action in case of a security lapse.

Incident Response Coordination:

- Action: Establish joint incident protocols and lines of communication for incident response involving third-party services. Including third parties in incident response drills and planning. These plans should be integrated into the institution's broader incident response strategy to ensure cohesive action in the event of a breach.

- Benefit: Enhances preparedness and ensures a coordinated response to security incidents, minimizing damage and recovery time.

Use of Secure Technologies for Data Sharing:

- Action: Implement secure interfaces and APIs for data exchanges with third parties. Ensure encryption of data in transit and at rest.

- Benefit: Reduces the risk of data interception or leakage when interacting with third-party services.

Segmentation of Network Access:

- Action: Limit third-party access to the institution’s network by implementing strict access controls and network segmentation.

- Benefit: Prevents widespread access across the network in the event of a breach, containing any potential damage.

- Leveraging Advanced Security Frameworks: In addition to the above, financial institutions can leverage frameworks like Zero Trust, which assumes no entity should be trusted by default, whether inside or outside the network. Implementing such a framework can further secure interactions with third-party vendors by requiring continuous verification of all access requests.

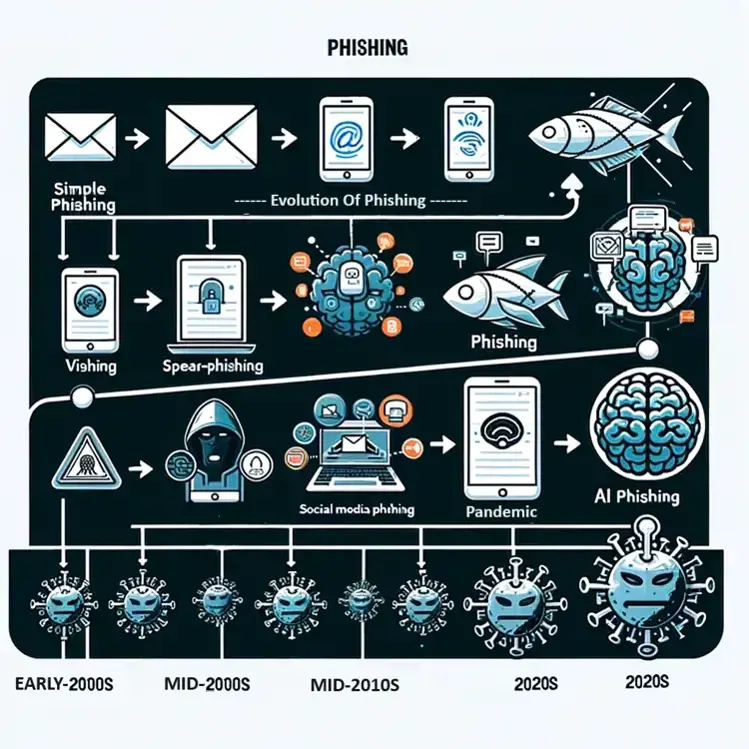

Advanced Phishing Attack Prevention

Phishing remains one of the most common and effective cyber threats to financial institutions, recently evolving in sophistication and precision due to A.I. These attacks exploiting human factors, to trick employees or customers into divulging sensitive information such as login credentials, financial data, or other personal details. Frequently to gain unauthorised access to sensitive systems To stay ahead of "phishers", financial institutions must continuously evaluate and improve their anti-phishing strategies. This includes staying updated with the latest phishing trends and collaborating with industry peers and cyber-security forums to share insights and best practices. Additionally, leveraging artificial intelligence to analyze patterns and predict phishing attacks can provide proactive defenses against these evolving threats.

Understanding the Evolving Nature of Phishing Attacks

Spear Phishing:

- Description: Unlike broad phishing campaigns, spear phishing targets specific individuals or groups within an organisation. These emails are crafted to look as legitimate as possible, often mimicking the format, language, and tone of regular communications from trusted sources.

- Impact: Increased likelihood of recipients taking the bait due to the personalized nature of the attack.

Whaling:

- Description: A form of spear phishing that targets senior executives or high-profile individuals within an organisation. The emails may involve requests for wire transfers or sensitive data.

- Impact: Potential for significant financial losses and breaches of executive-level communications.

Business Email Compromise (BEC):

- Description: Attackers gain access to or spoof a company’s email accounts to issue unauthorized instructions, such as changing payment details or transferring funds.

- Impact: Direct financial losses and compromised business operations.

Smishing and Vishing:

- Description: Phishing attacks also occur via SMS (Smishing) or voice calls (Vishing), where attackers exploit other communication channels to deceive their targets. These methods may be used to supplement email-based phishing, providing a more direct means of persuasion.

- Impact: Bypasses some traditional email defenses, reaching victims through less guarded communication channels.

Mitigation Strategies:

Multi-Layered Email Filtering:

- Action: Deploy sophisticated email security solutions that utilise machine learning algorithms to detect phishing attempts, including subtle clues in email headers, body text, and sender information. To detect and filter out phishing emails before they reach the user.

- Benefit: Reduces the volume of phishing emails reaching end-users, limiting opportunities for attackers.

Regular Security Awareness Training:

- Action: Implement ongoing training programs that include simulated phishing scenarios and tests to educate employees about the latest phishing techniques and tactics. Training should include recognising suspicious emails, understanding the risks of clicking on unknown links, and verifying requests for sensitive transactions.

- Benefit: Empowers employees with the knowledge and tools to recognize and appropriately respond to phishing attempts.

Phishing Simulation Exercises:

- Action: Regularly conduct controlled phishing attacks to test employee awareness and the effectiveness of current training programs.

- Benefit: This practical approach helps identify weaknesses within the workforce and reinforces the importance of vigilance.

Robust Verification Procedures:

- Action: Establish strict verification processes for financial transactions or requests for sensitive information, especially if initiated via email.

- Benefit: Adds an additional layer of security to catch fraudulent requests that may slip through initial defenses.

Multi-Factor Authentication (MFA):

- Action: Require MFA authentication across all critical systems and communication platforms, particularly those accessible via the internet to mitigate the damage of compromised credentials.

- Benefit: This adds an extra layer of security by requiring additional verification methods to ensure that a compromised password alone is not enough to access sensitive information.

Anti-Phishing Technologies:

- Action: Invest in and deploy technologies specifically designed to identify and neutralize phishing threats, such as link analysis tools and real-time threat detection systems.

- Benefit: Enhances the institution’s ability to respond immediately to detected phishing attempts, potentially stopping attacks before they succeed.

Prioritising Infrastructure and IoT Security

Prioritising the security of infrastructure and Internet of Things (IoT) devices is crucial for financial institutions as they increasingly rely on these technologies for daily operations and data management. The proliferation of connected devices and systems increases the complexity of security management and exposes institutions to new vulnerabilities. The interconnectedness of these systems with the Internet, combined with their often insufficient built-in security features, makes them prime targets for cyber-attacks, potentially leading to severe operational disruptions and security breaches.

Key Security Challenges in Infrastructure and IoT

Expanding Attack Surface:

- Description: Each IoT device and infrastructure component can potentially serve as an entry point for cyber attackers. Many of these devices have less stringent security measures compared to traditional IT equipment. And are connected to and managed by the cloud, opening up holes in otherwise secure networks.

- Impact: Increases the complexity of securing networks, as attackers can exploit a single weak device to gain access to the entire network.

Inherent Vulnerabilities:

- Description: Many IoT devices have minimal security features, are not regularly updated, and use default credentials, making them vulnerable to attacks.

- Impact: Simplifies the process for attackers to infiltrate networks, steal data, or disrupt services.

Integration Complexity:

- Description: The interconnected nature of modern financial systems means that a breach in one area can have cascading effects throughout the institution.

- Impact: Simplifies the process for attackers to infiltrate networks, steal data, or disrupt services.

Lack of Standardisation:

- Description: IoT devices lack implementation of consistent security standards across devices and manufacturers, leading to uneven security practices. IoT devices often lack standard security management protocols, making consistent protection across all devices challenging.

- Impact: Complicates the management and security of devices, as different devices may require unique handling.

Mitigation Strategies:

Security by Design:

- Action: Ensure that security measures are integrated into the design phase of all infrastructure projects and third party suppliers IoT implementations. This includes adopting secure coding practices and comprehensive security testing throughout the development lifecycle.

- Benefit: Proactively discovering security weaknesses and allowing for their remediation before they can be exploited by attackers.

Comprehensive Device Management:

- Action: Implement a centralised management solution for IoT devices that includes inventory tracking, regular security assessments, and patch management.

- Benefit: Ensures all devices are monitored, up-to-date, and secured against known vulnerabilities.

Network Segmentation:

- Action: Segregate IoT devices and critical infrastructure onto separate network segments, keeping IoT devices away from critical data and systems. This limits the ability of an attacker to move laterally across networks if they manage to compromise a single device or system. Use firewalls and intrusion detection/prevention systems to control and monitor traffic between segments.

- Benefit: Limits the potential damage from compromised IoT devices, preventing attackers from moving laterally within the network.

Regular Security Audits and Penetration Testing:

- Action: Conduct periodic security audits and penetration tests and ensure that all devices and systems are regularly updated with the latest security patches. This is crucial for addressing vulnerabilities that could be exploited by cyber attackers..

- Benefit: Proactively discovers security weaknesses and allows for their remediation before they can be exploited by attackers.

Implement Advanced Encryption Technologies:

- Action: Use strong encryption for data at rest and in transit from IoT devices to protect sensitive information.

- Benefit: Ensures data integrity and confidentiality, reducing the risk of data breaches.

Adopt Zero Trust Principles:

- Action: Apply zero trust security models to IoT and infrastructure systems, verifying and validating all devices and users before granting access.

- Benefit: Minimizes the risk of unauthorised access and enhances overall network security.

Leveraging Technology and Training

AI and Machine Learning:

- Action: Utilize AI and machine learning tools to monitor network behavior, detect anomalies, and automatically respond to potential threats in real-time.

- Benefit: Provides scalable, efficient, and effective monitoring and response capabilities, essential for the vast networks of IoT devices.

Employee Training and Awareness:

- Action: Regularly train staff on the specific risks associated with IoT devices, including the importance of security practices such as changing default passwords and recognising suspicious device behavior.

- Benefit: Reducing the risk of human error, which is often the weakest link in security chains.

Countering State-Sponsored Cyber Threats

State-sponsored cyber attacks are among the most sophisticated and potentially damaging threats faced by financial institutions. Financial institutions, with their wealth of sensitive financial data, are prime targets and must adopt robust strategies to defend against these high-level threats. State actors often possess advanced capabilities and resources, enabling them to execute complex cyber operations aimed at espionage, disruption, or gaining strategic advantages. targeting critical financial infrastructure to steal sensitive information, disrupt services, or manipulate financial markets. Countering state-sponsored cyber threats is paramount for financial institutions due to the sophisticated nature and potentially catastrophic impact of these attacks.

Characteristics of State-Sponsored Cyber Threats

Advanced Persistent Threats (APTs):

- Description: These threats involve long-term operations designed to stealthily infiltrate and and remain undetected for extended periods within a network to gather intelligence or cause disruption over time.

- Impact: Prolonged access to financial networks allows for continuous data theft, surveillance, and the potential to execute damaging actions at critical moments.

Sophisticated Malware and Exploits:

- Description: State-sponsored actors often use cutting-edge malware and zero-day exploits, which exploit vulnerabilities that are unknown to the software vendor and hence have no patches.

- Impact: These sophisticated tools can bypass conventional security measures, leading to undetected intrusions and significant breaches.

Supply Chain Attacks:

- Description: These attacks target less-secure elements in the supply chain as entry points into more secure systems within financial institutions.

- Impact: Compromising a single vendor or software can lead to widespread breaches across all users of the compromised service, including major financial institutions.

Cyber Espionage:

- Description: State actors often seek to access confidential financial information or intellectual property to gain economic or geopolitical advantages.

- Impact: Direct financial losses and compromised business operations.

Sabotage:

- Description: In some cases, the goal of state-sponsored attacks may be to disrupt financial stability or erode trust in financial institutions through targeted disruptions of financial services.

- Impact: Direct financial losses and compromised business operations.

Mitigation Strategies :

Enhanced Threat Intelligence and Sharing:

- Action: Collaborate with national cyber-security centers and international cyber-security organisations to share and receive updates on emerging threats, including those from state actors.

- Benefit: Early warning of new threats and coordinated responses enhance the ability to preempt and counteract state-sponsored attacks.

Robust Network Defenses and Segmentation:

- Action: Implement advanced defensive technologies, including intrusion prevention systems, anomaly detection, and network segmentation to limit the spread of an attack within the system.

- Benefit: Reduces the attack surface and confines potential breaches to isolated segments of the network, mitigating overall impact.

Regular Security Audits and Penetration Testing:

- Action: Conduct comprehensive audits and red team exercises to identify vulnerabilities that could be exploited by state-sponsored hackers.

- Benefit: Proactive identification and remediation of security weaknesses reduce the likelihood of successful breaches.

Incident Response and Crisis Management:

- Action: Develop and regularly update a specialised incident response plan that includes scenarios involving state-sponsored attacks, ensuring rapid containment and mitigation. This should involve rapid isolation of affected systems, forensic analysis to understand the breach, and coordination with governmental authorities.

- Benefit: Quick and effective response minimizes damage and accelerates recovery from sophisticated attacks.

Employee Training and Security Awareness:

- Action: Regular training programs to enhance the security awareness of all employees, focusing on the tactics used by state-sponsored actors, such as spear-phishing and social engineering.

- Benefit: Educated employees are less likely to fall victim to initial entry tactics, forming a critical line of defense.

Advanced Cyber Defense Technologies

Employ state-of-the-art cyber-security technologies, including AI-driven threat detection systems and blockchain for enhanced data integrity, which can help detect and counter sophisticated cyber attacks.

Zero Trust Architecture:

- Action: Implement a Zero Trust security model where no entity, whether inside or outside the network, is trusted by default. Continuous verification and strict access controls are enforced.

- Benefit: Significantly enhances security against internal and external breaches, a necessary defense against the level of threat posed by state actors.

Crypto-Agility:

- Action: Prepare for and adapt to the cryptographic challenges posed by state-sponsored actors, including the potential future threats from quantum computing.

- Benefit: Ensures that financial institutions can maintain confidentiality and integrity of data against advanced decryption capabilities.

Responding to Advanced Social Engineering Attacks

Social engineering remains one of the most insidious cyber-security threats faced by financial institutions, leveraging human psychology to breach defenses. As these tactics become increasingly sophisticated, institutions must adapt their strategies to effectively mitigate the risks.Responding effectively to advanced social engineering tactics becomes critical for financial institutions due to the high risk these methods pose. Social engineering manipulates individuals into divulging confidential information, executing unauthorised transactions, or granting access to restricted systems. As these attacks become more sophisticated, integrating psychological manipulation with advanced A.I.technology, financial institutions must enhance their defenses to protect sensitive data and maintain the integrity of their systems.

Understanding Advanced Social Engineering Attacks

Deepfake Technology:

- Description: Cybercriminals use AI-generated audio and visual content to impersonate senior executives or trusted entities, manipulating employees into performing unauthorized actions or divulging confidential information.

- Impact: Can lead to significant breaches of trust, misinformation, and unauthorized actions if employees are deceived by the realistic appearance of communications.

Spear Phishing:

- Description: More targeted than generic phishing, spear phishing involves emails or messages that are highly customised to the recipient, often using personal information to increase the appearance of legitimacy.

- Impact: More likely to result in the divulgence of sensitive information or execution of harmful actions due to the personalized nature of the request.

Pretexting:

- Description: The creation of a fabricated scenario or pretext to engage a targeted individual in a manner that leads to the disclosure of confidential information.

- Impact: By establishing trust or authority, attackers can obtain critical information needed to further penetrate secure environments.

Baiting:

- Description: Involves offering something enticing to the target as a means to gain unauthorized access or information.

- Impact: Exploits human curiosity or desire, leading to security lapses when the bait is taken.

Psychological Manipulation:

- Description: Tactics like urgency, fear, or authority are employed to coax victims into making security mistakes, such as providing access credentials or initiating unauthorized transactions.

- Impact: More likely to result in the divulgence of sensitive information or execution of harmful actions.

Mitigation Strategies to Counter Advanced Social Engineering

Comprehensive Training and Awareness Programs:

- Action: Regular and comprehensive training sessions should be conducted to educate employees about the latest social engineering tactics. Training should emphasize critical thinking and scepticism, especially regarding requests for sensitive information or urgent actions, including the latest techniques like deepfake recognition's and pretexting.

- Benefit: Educated employees are the first line of defense against social engineering, reducing the risk of successful attacks

.Simulation Exercises:

- Action: Conduct regular social engineering drills and simulations to test employee preparedness. These exercises should mimic real-life scenarios to provide employees with practical experience in detecting and responding to sophisticated social engineering attacks..

- Benefit: Reinforces training, increases vigilance, and helps identify areas where additional training may be necessary.

Robust Verification Processes:

- Action: Establish strict verification procedures for all unusual or unexpected requests, particularly those involving financial transactions or access to critical data. This could involve multiple forms of verification, such as phone calls and secondary email confirmations, especially for unusual or unexpected requests.

- Benefit: Acts as a safeguard against deceitful requests, ensuring that actions are authenticated and authorised.

Multi-Factor Authentication (MFA):

- Action: Enforce MFA across all systems, particularly for access to sensitive data and executive communication channels.

- Benefit: MFA provides an additional security layer that compensates for potential human errors in judgment.

Policy of Least Privilege:

- Action: Ensure that access to sensitive information and systems is restricted to only those who need it to perform their job functions.

- Benefit: Minimizes the potential damage from insider threats or successful social engineering breaches.

Leveraging Technology to Enhance Security

AI and Machine Learning:

- Action: Utilize AI-driven security tools that can analyse patterns of communication and flag anomalies that may indicate attempted social engineering.

- Benefit: Helps detect sophisticated scams that might not be obvious to human reviewers, including detecting signs of deepfake technology.

Incident Response Team:

- Action: Develop a specialised incident response team focused on handling social engineering attacks, capable of rapid assessment and mitigation.

- Benefit: Ensures quick and effective responses to identified threats, reducing potential damage.

Implementing a Zero Trust Security Model

The Zero Trust security model operates under the principle that no individual or device should be trusted by default, irrespective of their location relative to the network perimeter. Which is particularly effective against the backdrop of increasing internal and external threats, and the expanding perimeter brought about by remote work and cloud technologies.Implementing a Zero Trust security model is becoming increasingly vital in the complex and threat-prone digital environments of financial institutions with financial institutions aiming to enhance their cyber-security posture.

Key Principles of Zero Trust

Least Privilege Access:

- Description: Each user or device is granted the minimum access necessary to perform their functions. This limits the potential damage in case of a breach.

- Impact: This minimizes potential damage in the event of account compromise, as malicious actors have limited access.

Microsegmentation:

- Description: The network is divided into smaller, secure zones, where users can only access the network segments necessary for their work.Even if attackers breach one segment, they are contained and prevented from moving laterally across the network.

- Impact: This limits the lateral movement of attackers within the network, containing breaches to isolated segments.

Continuous Monitoring and Verification:

- Description: All users and devices must be authenticated and authorised continuously to gain or maintain access., not just at the initial point of access.

- Impact: Enhances security by ensuring that credentials are continually validated, which is crucial in detecting and responding to threats in real-time.

Steps to Implement Zero Trust

Identify Sensitive Data and Systems:

- Action: Start by mapping out where sensitive data resides, and Identify which data, assets, applications, and services are critical and must be protected. Understanding these elements helps define the scope and requirements for the Zero Trust model.

- Benefit: Focuses security measures on protecting vital assets rather than trying to secure the entire network, which is often impractical.

Map the Transaction Flows:

- Action: Understand how data moves across your organization and where critical transactions occur. This mapping will inform how to implement controls and monitor traffic.

- Benefit: Helps in creating effective policies and controls that reflect the actual usage and flow of data, enhancing the effectiveness of security measures.

Architect a Zero Trust Network:

- Action: Based on the identified protect surface and transaction flows, design a network architecture that segments access according to the principle of least privilege.

- Benefit: This structured approach to network access minimizes the risk of unauthorised access and data breaches.

Architect a Micro segmented Network:

- Action: Design and implement a network that separates critical assets and services from each other, using physical or virtual segmentation to control access paths and flows.

- Benefit: This structured approach to network access minimizes the risk of unauthorised access and data breaches.

Enforce Multi-Factor Authentication (MFA):

- Action: MFA should be mandatory across all access points, including remote access to ensure that stolen credentials alone cannot be used to gain unauthorised access

- Benefit: Using MFA minimises the risk of unauthorised access and data breaches.

Continuous Monitoring and Improvement:

- Action: Develop and enforce policy statements that govern who can access what information under which conditions across the network.Regularly review and update access controls and response strategies to adapt to new threats or changes in the organisation

- Benefit: Ensures consistent application of security rules, which helps in maintaining stringent access controls.

Monitor and Maintain:

- Action: Utilise security automation tools to monitor access requests and verify user identities in real time, reducing the latency and potential errors in manual processes. Monitor network and system activities for unusual or unauthorised behavior, which could indicate a security breach.

- Benefit: Provides ongoing visibility into network operations and security status, facilitating rapid detection and response to threats.

Leveraging Technology for Zero Trust

Security Automation and Orchestration:

- Action: Utilize automation tools to dynamically enforce security policies and perform real-time threat analysis and mitigation.

- Benefit: Increases the efficiency and effectiveness of security operations, reduces the burden on security teams, and speeds up response times.

Advanced Threat Intelligence:

- Action: Integrate threat intelligence platforms that provide real-time information about emerging threats and recommended security measures.

- Benefit: Keeps the institution ahead of potential threats by enabling proactive adjustments to security policies and practices.

Strengthening Cloud Security Practices

As financial institutions increasingly adopt cloud services for their scalability, cost-effectiveness, and operational flexibility, the need to secure these environments becomes paramount. Cloud security encompasses a range of practices designed to protect cloud-based systems, data, and infrastructure from both external and internal threats, while maintaining compliance with financial regulations.

Challenges in Cloud Security

Data Breaches and Data Loss:

- Description: Unauthorised access to sensitive data stored in the cloud can lead to significant financial and reputational damage, while data can also be lost through mishandling or malfunctions.

- Impact: Breaches and loss of data can lead to significant financial penalties, loss of customer trust, and reputational damage.

Misconfiguration and Inadequate Change Control:

- Description: Incorrectly configured cloud services are a common vulnerability that can expose systems to attacks.. Without strict controls, unintended changes can introduce risks.

- Impact: Misconfigurations can expose financial data to unauthorised parties and create entry points for attackers.

Lack of Visibility and Control Over Data:

- Description: Cloud environments can obscure visibility into where data is stored and how it is protected, complicating governance and risk management.

- Impact: Without clear visibility, it's challenging to ensure that all data is adequately protected according to regulatory standards and internal policies.

Mitigation Strategies :

Cloud Security Posture Management (CSPM):

- Action: Implement tools that continuously monitor and manage cloud security configurations and compliance risks in cloud environments. To ensure compliance with security policies and prevent misconfigurations.

- Benefit: Enhances security by ensuring configurations meet best practices and compliance requirements continuously.

Encryption of Data at Rest and in Transit:

- Action: Encrypt data at rest and in transit to protect sensitive information from interception or exposure. using robust encryption standards.

- Benefit: Protects sensitive information from being accessed by unauthorised users, even if they gain access to the cloud storage or network.

Access Controls and Identity Management:

- Action: Use robust identity and access management (IAM) systems to enforce multi-factor authentication, least privilege, and other access controls. Ensuring that only authorised users have access to cloud resources is critical to preventing data leakage.

- Benefit: Minimizes the risk of data breaches by reducing the number of people who can access sensitive information.

Regular Security Audits and Penetration Testing:

- Action: Conduct regular audits of your cloud environment and associated controls. Perform penetration testing to identify and address vulnerabilities.

- Benefit: Proactively identifies potential security weaknesses so they can be addressed before being exploited by attackers.

Multi-Factor Authentication (MFA):

- Action: Implement MFA for all cloud services to add an additional layer of security for accessing cloud resources.

- Benefit: Reduces the risk of unauthorised access due to compromised credentials.

Adopting a Comprehensive Cloud Security Framework

- Action: Align cloud security practices with established standards such as ISO 27001, NIST, and CSA CCM

- Benefit: Ensures comprehensive security coverage and aids in compliance with industry and regulatory requirements.

Compliance:

- Action: Meeting regulatory requirements is especially challenging in the cloud, where data might be stored across multiple jurisdictions.

- Benefit: Ensures that comprehensive security coverage aids in compliance with industry and regulatory requirements.

Cloud Vendor Management:

- Action: Carefully select cloud service providers (CSPs) with robust security measures and clear policies and ensure they comply with industry-standard security practices. Regularly review and manage these relationships to ensure ongoing compliance with security requirements.

- Benefit: Mitigates risks associated with third-party vendors and ensures alignment with security objectives.

Training and Awareness Programs:

- Action: Train all employees on cloud security best practices and the specific risks associated with cloud computing.

- Benefit: Enhances the overall security culture and reduces the risk of human errors leading to security incidents.

Key Components of an Effective IR Plan

An effective Incident Response (IR) plan is crucial for financial institutions to manage and mitigate the impact of cyber-security incidents. The plan provides a structured approach for responding to breaches and threats, ensuring that the institution can quickly contain the incident, minimize damage, and restore operations as swiftly as possible.

Key Components of an Effective Incident Response Plan

Preparation:

- Developing and maintaining a comprehensive IR plan that is regularly updated to reflect the evolving threat landscape and business processes.

- Description: This foundational step involves setting up the right tools, policies, and procedures before an incident occurs. It includes the establishment of an incident response team with clearly defined roles and responsibilities.

- Impact: Adequate preparation ensures the organization is ready to respond efficiently and effectively to security incidents, reducing potential downtime and losses.

Identification:

- Implementing advanced monitoring tools to detect and identify security incidents quickly. The faster an incident is identified, the quicker it can be contained.

- Description: Rapidly detecting and identifying a cybersecurity incident is critical. This involves monitoring systems and networks for signs of a breach and distinguishing false alarms from real threats.

- Impact: Early identification allows for quicker response times, potentially limiting the spread and severity of damage.

Containment:

- Short-term and long-term containment strategies must be in place to limit the spread of an attack. Short-term containment may involve isolating affected systems, while long-term containment focuses on removing the threat permanently.

- Description: Once an incident is identified, immediate action is taken to contain it. Containment strategies are bifurcated into short-term (to stop the immediate threat) and long-term (to ensure the threat is completely neutralized) actions.

- Impact: Effective containment prevents further damage by isolating affected systems and stopping the incident from spreading to unaffected areas.

Eradication:

- Once contained, the root cause of the incident needs to be found and eradicated from the environment. This might involve removing malware, closing vulnerabilities, and updating policies.

- Description: After containment, the next step is to remove the threat from the environment. This includes eliminating malware, closing security gaps, and addressing vulnerabilities that were exploited.

- Impact: Eradication ensures that the threat is completely removed from the institution’s systems,

preventing recurrence.

Recovery:

- Restoring and validating system functionality for business operations by bringing systems back online carefully to prevent re-infection.

- Description: The focus shifts to restoring and validating system functionality for business operations. This includes the careful lifting of containment measures, restoration of systems and data from clean backups, and continuous monitoring for any signs of weakness.

- Impact: Proper recovery actions ensure that business operations can return to normal securely and confidently, minimizing the risk of hidden threats.

Lessons Learned:

- After an incident, conducting a thorough review to determine what happened, how it was handled, and how future incidents can be prevented or mitigated.

- Description: Post-incident reviews are critical. The incident response team analyzes what happened, how it was handled, what could be done better, and updates the IR plan accordingly.

- Impact: This continuous improvement cycle enhances the organization's resilience against future incidents and refines response strategies.

Additional Considerations for Financial Institutions:

Regulatory Compliance:

- Financial institutions must also consider regulatory requirements when responding to incidents. This includes compliance with laws and regulations related to data breaches, such as GDPR or GLBA, which might dictate specific response measures or notification timelines.

Incident Response Team:

- Establish a skilled IR team with clear roles and responsibilities. This team should include members from various departments, such as IT, legal, and communications.

Communication Strategy:

- An effective communication plan should be part of the IR strategy, outlining how to communicate with internal stakeholders, customers, partners, and possibly the public. Managing the message during and after an incident is crucial for maintaining trust and transparency.

Training and Simulations:

- Regular training and simulated cyber attack exercises for the IR team help prepare them for real incidents. These drills should be as realistic as possible and cover various scenarios..

Integration with Business Continuity:

- The IR plan should be closely aligned with the institution’s business continuity planning (BCP). This ensures that not only is the security incident contained and eradicated, but that the business can also continue to operate effectively under adverse conditions.

Conclusion: Staying Ahead of Cyber Threats

It is evident that the cyber threat landscape is not only growing more complex but also more perilous, particularly for financial institutions. Financial organisations are prime targets due to the sensitive financial data they manage and their pivotal role in the global economy. Staying ahead of cyber threats in such an environment requires a proactive, informed, and multifaceted approach to cyber-security.

Moving Forward

The financial sector's reliance on digital technology will continue to increase, and with it, the sophistication of cyber threats. By investing in advanced security technologies, promoting a culture of cyber awareness, implementing robust governance and compliance frameworks, and fostering industry collaboration, financial institutions can navigate these challenges with confidence.

The proactive strategies that we have discussed will not only help financial institutions defend against current cyber threats but also prepare them for future challenges, ensuring resilience and trust in an increasingly interconnected world.

For More Information Please Contact Us

ACCREDITATIONS